Guidelines Sales Tax Service Tax Return SST-02 Click Here. For payment of taxes online the maximum payment allowable is as follows.

Malaysian Service Tax Submission 2018 Mandarin Youtube

Forms SST-02 and SST-02A are used to report sales tax and services tax and address procedures on filing these forms as well as the available payment methods.

. Alternatively payments by Cheque or Bank Drafts on the name of Ketua Pengarah Kastam Malaysia can be submitted by post to. The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come into effect in 1 September 2018. A Download SST-02 from portal MySST and type in by using capital letter.

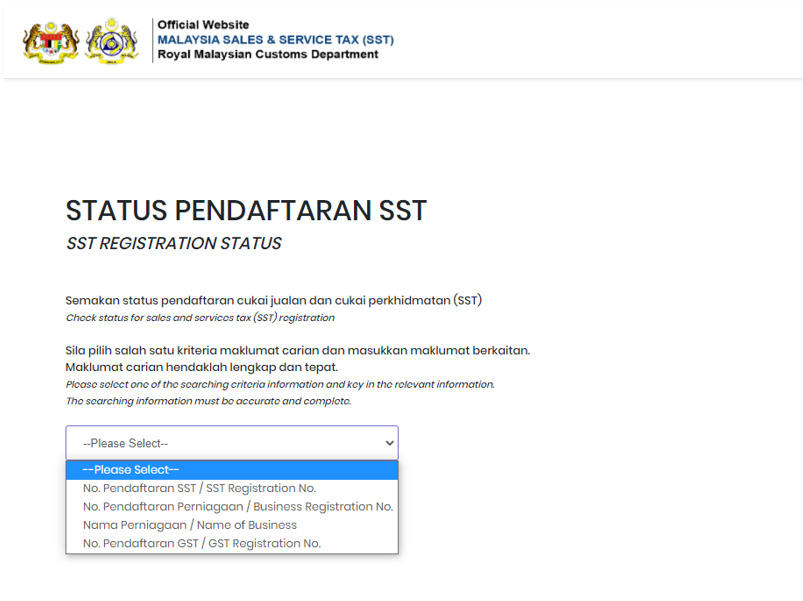

Below are the simple steps that illustrate the SST registration in Malaysia. 48 rows SST-02 Form. SST-02A Form Service Tax Declaration By Other Than Registered Person Click Here.

Download the Form SST-02 from the MySST portal and mail it to the Customs Processing Centre CPC by post. And b The complete form must be posted to the following address. This also means all foreign entities including Labuan company who deal with Malaysian required to register the SST account as well.

Steps for Registration for SST Account. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Customs Processing Centre CPC Jabatan Kastam Diraja Malaysia Kompleks Kastam WPKL No.

22 Jalan SS 63 Kelana Jaya 47301 Petaling Jaya Selangor. Returns must be submitted whether the tax has been paid or not. Companies will need to submit SST return by the end of your taxable period.

However the first taxable period of one company may differ from another. Ensure your eligibility in order to proceed to get yourself registered with the right SST code and documents required to apply. On the Sales tax tab in the Tax options section in the Electronic reporting field select SST-02 Declaration Excel MY.

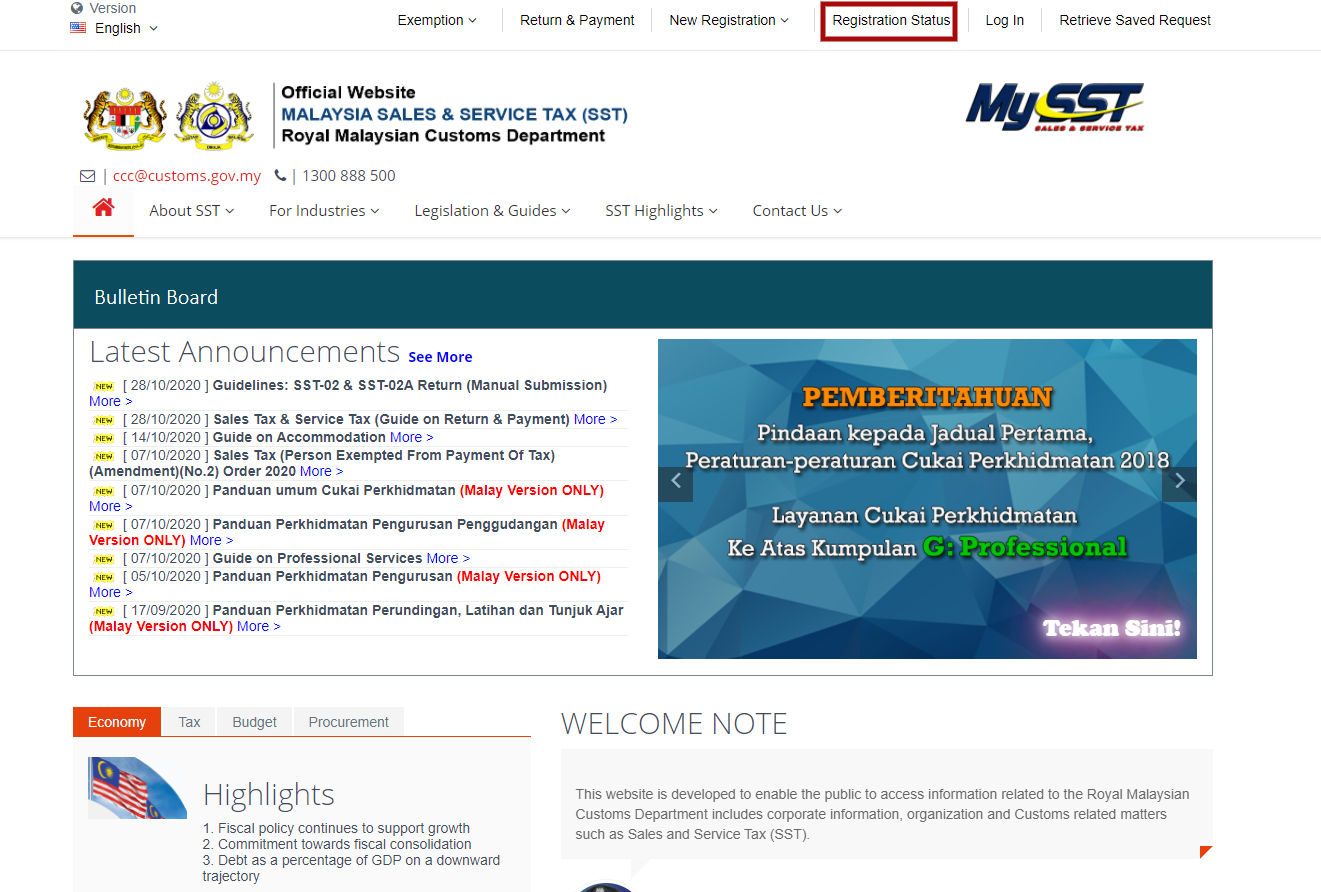

The address is as follows. Suspension of the requirement to file a country-by-country CbC report. Official Website of Malaysia Sales Service Tax SST also released an announcement of USER MANUAL FOR ONLINE RETURN AND PAYMENT SUBMISSION by Royal Malaysia Custom Department at httpsmysstcustomsgovmy.

If you leave the SST statement format mapping field blank the standard sales tax report will be generated in SQL Server Reporting Services SSRS format. Sales tax and service tax guide on returns and payment. I User Manual Registration Click Here.

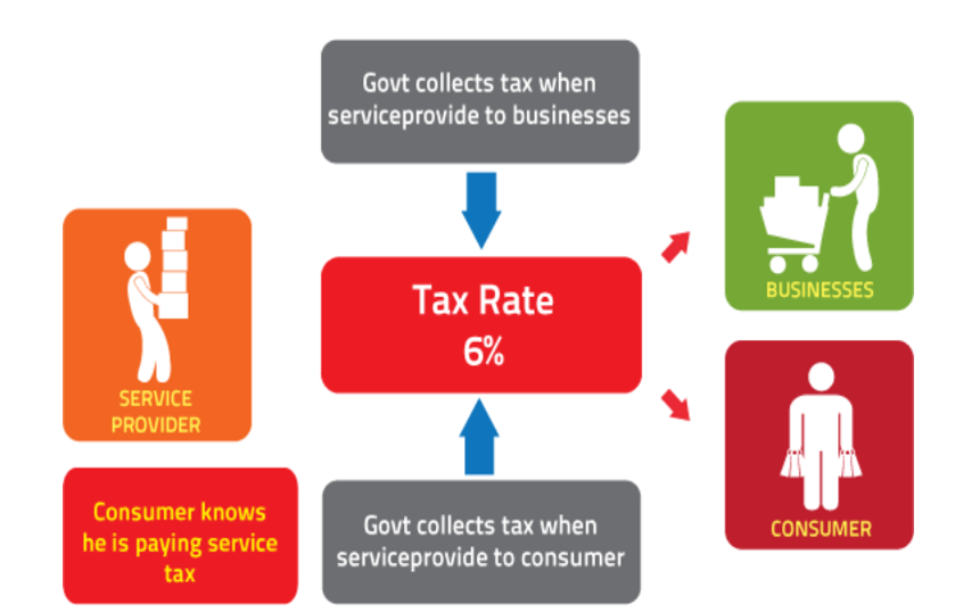

The recently introduced Sales and Services Tax SST in Malaysia came into effect beginning 1 September 2018. The new SST in Malaysia is a single-stage tax system which. Payment of sales tax and service tax can be made electronically through the MySST system Financial Process Exchange FPX or manually by cheque or bank draft.

The SST is a replacement of the previous Goods and Services Tax GST in Malaysia which prior to this imposed a 6 tax rate on all taxable goods and services. As mentioned earlier in this article all companies will follow a 2 months taxable period. Once eligible to pay the SST the applicant intended to register for sales and service tax need to Google hisher way to the government website called MySST portal.

Ii How to Apply Online for Registration Sales Tax Or Service Tax Video Link Click Here. Guide to Filling the SST-02 Tax Return Manually. KNOW HOW TO SUBMIT YOUR RETURN AND PAYMENT THROUGH ONLINE CHECKES BANK DRAFTS.

You must submit your Tax Return electronically via httpsmysstcustomsgovmy and payments can be made after return submission in the same portal via FPX facility with 17 banks to choose from. SST in Malaysia and How It Works. SST Deregistration Process in Malaysia.

Returns can be submitted either by post or electronically. Claim for Refund Drawback of Duty Tax Others. All SST returns must not be submitted later than the last day of the following month after the taxable period has ended or risk being hit with a penalty.

Governed by the Sales Tax Act 2018 and the Service Tax Act 2018 the Sales Tax was a federal consumption tax. Before the 6 GST that was implemented in 2015 Malaysia levied a Sales Tax and a Service Tax. To submit your SST return first you need to confirm your taxable period.

For corporate account payments B2B the amount is RM100 million. Select the category hierarchy. Jabatan Kastam Diraja Malaysia Pusat Pemprosesan Kastam Kompleks Kastam Kelana Jaya No22 Jalan SS63 Kelana Jaya 47301 Petaling Jaya Selangor.

I User Manual for Online Return and Payment Submission. The updated guides are available on the government website. The direct link for this particular portal is.

SST-03 Application Form Application For Review Click Here.

Sst Return Sst 02 Service Tax Help

Sales Tax 2 0 Mysst Submission Mandarin Youtube

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

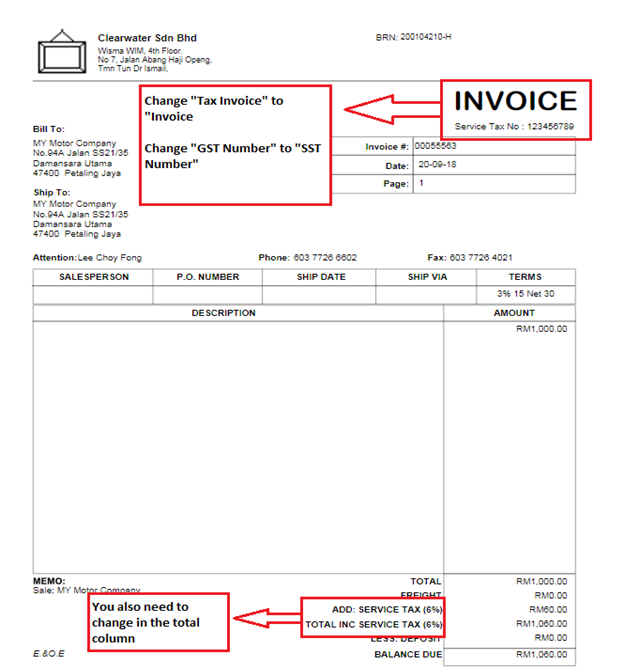

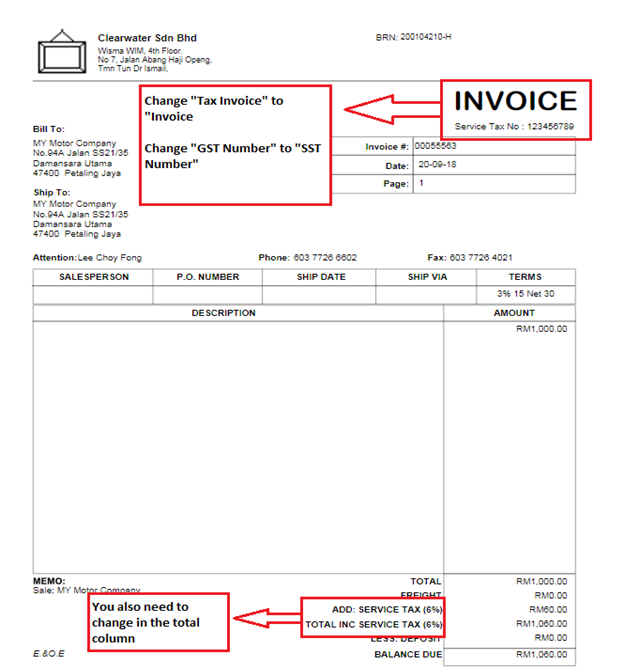

Sst Customized Form Abss Support

Sst How To Declare Sst Return In Treezsoft Treezsoft Blog

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Sst Sales And Service Tax A Complete Guide

7 Must Knows About Sst Payments For F B Company In Malaysia